Sales enablement in the AI era starts before the first call — inside the 70% of the buyer journey your team never sees. If buyers complete 70% of their B2B buying journey before contacting sales, the question isn’t how to get sales involved earlier.

It’s what sales should be doing with the 30% that remains—and how the other 70% needs to be designed so that buyers arrive with accurate perception, not distorted fragments.

Sales enablement in the zero-contact era is not about better scripts, faster outreach, or more AI tools in the sales stack. It’s about redesigning what buyers encounter during the 70% your team never sees—so that the 30% where sales does engage inherits truth instead of confusion.

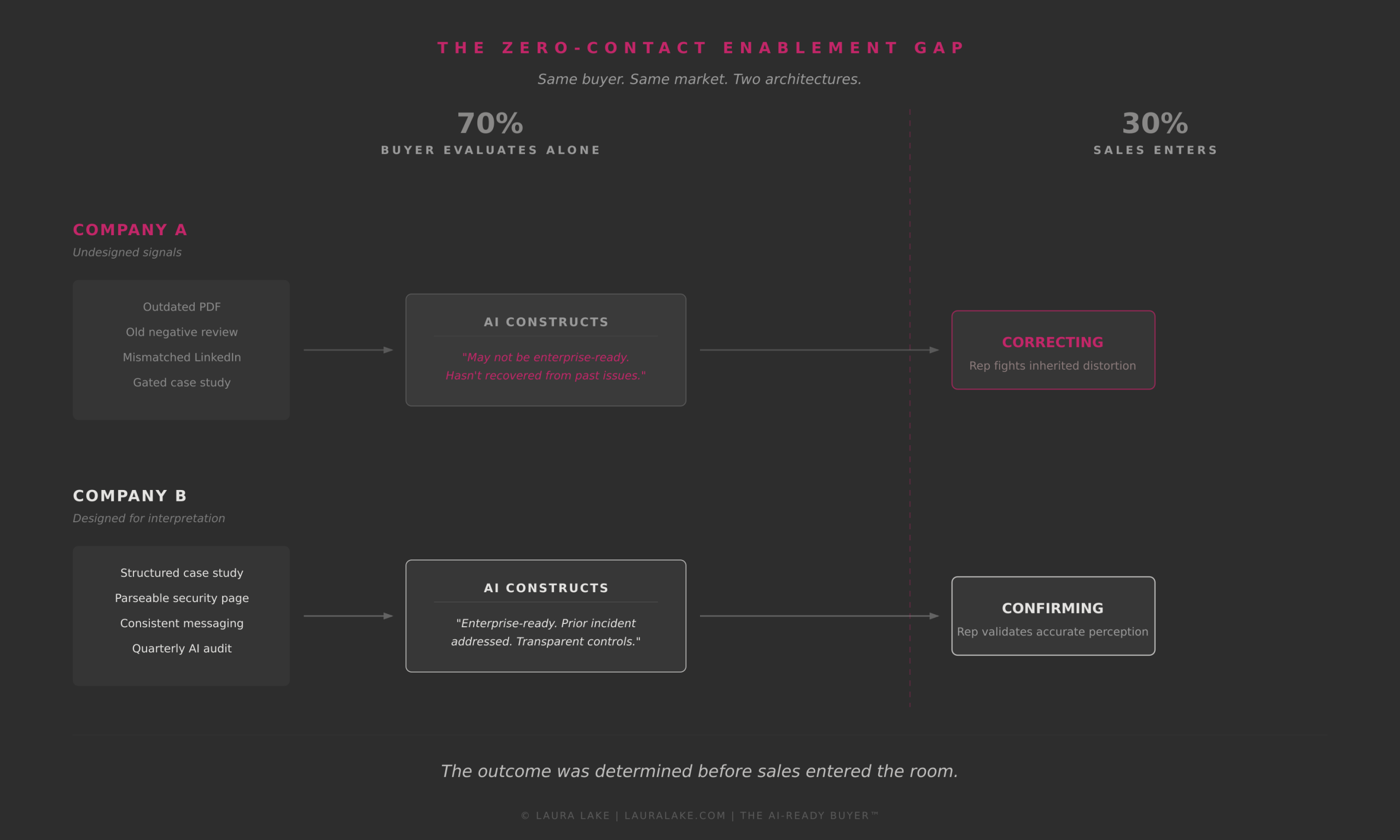

I call this the Zero-Contact Enablement Gap: the distance between the perception buyers form in the 70% you never see and the reality your sales team is prepared to validate in the 30% you do.

A regional software company ran discovery with a prospect who’d completed three months of internal evaluation before scheduling the first call. The buyer opened with, “We’ve already built the business case. We just need to confirm a few technical details.”

The sales rep asked what their understanding of the platform’s capabilities was. The buyer described a feature set that hadn’t existed in two years. Their AI-generated summary had pulled from outdated documentation. The internal business case—three months of committee work, budget approval secured, executive sign-off complete—was built on a version of the product that no longer existed.

The deal didn’t die from misalignment. It died from the structural impossibility of correction. You cannot rebuild a business case once the committee has moved on. The champion had already spent credibility getting internal buy-in. Restarting that process with new information looked like failure. The deal stalled indefinitely.

The rep only found out six months later, when a mutual contact mentioned the company had quietly chosen a different vendor. The business case held. The vendor changed.

Sales didn’t lose that deal. The 70% did.

Why the Old Sales Enablement Model No Longer Works

For decades, sales enablement optimized for a world where vendors controlled the narrative. Buyers contacted you early. Discovery happened in conversations you led. Education was something your team delivered. Objection handling assumed you’d be in the room when doubt formed.

That model depended on buyer dependence on vendor-controlled information.

Now buyers complete most of their evaluation independently—inside AI-generated B2B vendor summaries and peer review platforms, internal Slack threads, and private research sessions where tools synthesize your public signals without your input. By the time they contact sales, perception has formed. The shortlist is set. Evaluation criteria are defined.

Sales isn’t entering early in the buyer journey. Sales is entering late in a decision process that’s been running without you.

Once AI-generated summaries and internal evaluation docs frame the landscape, you’re not shaping the questions. You’re answering questions someone else wrote.

Early understanding of how buying committees have already interpreted you is the new advantage. Late entry is permanent.

Shift 1: From Persuasion to Validation in AI-Era Sales

Sales used to build the case. Now sales inherits the case—built from whatever signals the Silent Committee surfaced during independent evaluation.

The job isn’t to convince. It’s to validate accurate perception and correct distorted perception before it gets written into internal documents.

How Validation-First Discovery Works

A SaaS company restructured discovery around one opening move:

“Before we dive in, can you walk me through what your team already understands about us—where that perception came from, and what gaps you’re trying to fill in this conversation?”

Patterns emerged fast:

- Most prospects had seen an AI-generated comparison that positioned them against the wrong competitors.

- Evaluation criteria were often anchored to a case study from a completely different vertical.

- Implementation risk was being judged on an old review describing a rollout process the company had redesigned a year earlier.

Reps weren’t uncovering needs. They were inheriting narratives assembled from fragments—some accurate, some outdated, some from sources the company didn’t even know existed.

Teams that surfaced and corrected those narratives in the first conversation saw deals move faster and with fewer surprises. Teams that ran traditional discovery—pain, budget, timeline—found themselves arguing against criteria that had been locked in long before the first meeting.

You can’t sell to a perception you don’t know exists.

What Is Perception Mapping in Sales Discovery?

Perception mapping is a discovery technique where the sales rep’s first priority is auditing what the buyer already believes—based on AI summaries, peer input, and internal research—before introducing any new information.

In this model, “discovery” isn’t a hunt for hidden pain. It’s a deliberate pass through the stories, summaries, and internal narratives the buyer is already carrying into the room, before you introduce a single new slide.

Questions change accordingly:

- What sources shaped your understanding of us before this call?

- When you evaluated us against [Competitor X], what did you see as the core difference?

- What did your internal write-up say about us?

The goal of the first meeting stops being education. It becomes alignment: making sure the story in the buyer’s head is close enough to reality that the rest of the process isn’t spent correcting a business case that was doomed from the first summary.

Shift 2: From Controlling the Narrative to Shaping Interpretation

You can’t control what an AI copilot says about you when someone prompts it for “best vendors for X in Y industry.” You can’t control which review surfaces when a risk-holder searches your name plus “security issue.” You can’t control which three bullet points a champion pulls into a steering deck five minutes before the meeting starts.

But you can shape what those systems and people have to work with.

This shift is about designing the 70%—the surfaces buyers encounter during independent research—so that when AI copilots and humans synthesize your signals, the interpretation that forms is accurate.

How AI Copilots Construct Vendor Perception: Two Examples

Consider two companies selling into the same enterprise segment.

Company A still operates on the old model:

- Case studies live in 40-page PDFs behind forms.

- Security documentation is a single “Overview_2023_Final_v7.pdf” uploaded as an attachment.

- Executives post loosely related thought leadership on LinkedIn with positioning that doesn’t match the website.

- No one is responsible for what AI tools are currently saying about them.

When a buying committee member prompts an AI copilot, it pulls: an outdated analyst note, a two-year-old negative review about a security incident, and a blog post describing them as a “mid-market” solution. The summary that circulates internally is: “Not sure they’ve fully recovered from past issues; may not be enterprise-ready.”

Nobody at Company A sees that summary.

Six months later, a new enablement leader decides to find out “what AI thinks of us” before a kickoff. She types their own name into a copilot and gets back the same summary the committees have been seeing: the old incident, the mid-market label, no mention of the enterprise customers the team talks about in every QBR.

The room goes quiet. For the first time, they see the version of themselves the Silent Committee has been evaluating.

Company B designs for interpretation:

- Case studies are one-page narratives with a single, copyable outcome and a public link to methodology.

- Security and compliance answers live in structured pages AI can parse, not buried in attachments.

- LinkedIn content, website messaging, and customer stories share the same language about who they serve and why they win.

- Once a quarter, someone runs “AI summary audits” on the company and its top competitors across a few copilots and logs what comes back.

When an AI copilot is prompted, it pulls: recent case study outcomes, a clear positioning statement used consistently across surfaces, and a current security page that directly addresses the prior incident and what changed. The summary that circulates is: “Enterprise-ready vendor, previously had an incident, now has more transparent controls than peers.”

Both companies have the same history. One lets AI freeze the worst version of that history in place. The other makes sure the most recent, most structured signals tell a different story.

AI isn’t neutral. It constructs an interpretation from the signals you give it. If you don’t design those signals, you inherit whatever the internet decided you are.

For a deeper breakdown of how these signals interact, see how AI trust signals shape B2B buying decisions.

Why Proof Portability Determines B2B Deal Outcomes

In this environment, “better decks” and “sharper talk tracks” don’t fix the problem. The real control point becomes portability: whether your proof can survive being compressed into three bullets and a link without you in the room.

A mid-market infrastructure company learned this after losing three consecutive deals to the same competitor. Win–loss interviews all came back to a single line: “They made it easier for our champion to build the internal case.”

The competitor’s advantage wasn’t product. It was interpretation. Their materials were designed to be re-interpreted correctly by someone else’s AI and someone else’s steering committee.

The losing vendor’s proof was stronger. It just couldn’t survive being summarized.

Shift 3: From Measuring Activity to Measuring Confidence

Calls made. Emails sent. Meetings booked. Demos delivered.

Those metrics describe how hard your team is working. They don’t tell you whether a buying committee feels safe choosing you—something mirrored in research on losing sales to customer indecision.

What matters now is whether confidence is compounding inside the account when you’re not there: confidence in the problem framing, in your fit, and in the risk math stakeholders are doing in private—patterns that show up clearly in Forrester’s 2026 State of Business Buying.

Why B2B Deals Stall: The Champion-to-Committee Confidence Gap

B2B deals stall when the champion who believes in your solution cannot retell your proof in a way that survives scrutiny from finance, risk, and peer stakeholders inside the buying committee.

One sales leader reviewed 30 stalled deals from the previous year. The pattern was almost identical every time:

- Discovery calls went well.

- Champions were engaged and positive.

- Technical validation finished without major issues.

- Pricing landed inside the expected band.

Then everything froze under the same phrase: “We’re still building the business case internally.”

Inside those accounts, something else was happening. Champions couldn’t retell the vendor’s proof in a way that survived scrutiny. Finance leaders wanted a number and a method. Risk-holders wanted a page they could send to their teams. Peers wanted a story that made sense in their own words.

They got forwarded decks, PDFs, and links that required the vendor to be present.

The vendor had optimized for activity with the champion. They had not optimized for confidence across the committee.

Champion confidence and committee confidence are not the same thing.

Looking at the data side by side made it obvious:

- In stalled deals, activity was high—dozens of emails, multiple demos, long CRM threads—but nobody inside the account could repeat a single concrete outcome or how it was measured.

- In closed-won deals, there were fewer meetings—but always one person who could point to one outcome, one stat, and one link that held up when a CFO or risk-holder pushed back.

The difference wasn’t effort. It was whether anyone inside the buying committee could make the case without inviting the vendor back into the room.

How to Measure Buyer Confidence Instead of Sales Activity

Buyer confidence is measured by whether anyone inside the account can already make your case without you present—using portable proof, a single verifiable outcome, and a story that holds up when challenged.

When teams shift from activity to confidence, the questions they ask themselves change:

- Is there at least one person in this account who can already tell our story in one sentence that would make sense to their CFO?

- Is there a single outcome, with a verifiable method, that a skeptic could click into without talking to us?

- Has anyone on our side looked at the AI-generated summaries this account is likely seeing about us and our competitors?

One team that did this cut its average sales cycle by 40%. The win wasn’t speed. The win was clarity: they stopped advancing deals where no internal confidence could form, no matter how many steps they added to the playbook.

The deals that closed weren’t the ones with the most activity. They were the ones where, somewhere inside the account, the case could stand up without a salesperson in the room.

Can your champion make your case without you? If not, the rest of the funnel is theater.

The deals that feel random in your forecast are often perfectly logical inside the version of your story that never makes it back to you.

The New Sales Enablement Advantage: Designing for the 70%

Two organizations can sell into the same accounts with the same product quality and similar pricing and get radically different outcomes:

- One treats sales as the starting line, measures effort, and tries to fix misinterpretation one call at a time.

- The other treats sales as inheritance, measures confidence, and designs upstream so that by the time a rep joins the conversation, the hard work of interpretation has already been done in their favor.

The first organization keeps asking why its best decks and sharpest reps can’t turn late-stage opportunities into predictable revenue. The second quietly stops seeing those problems, because the 70% is doing more of the work.

Sales enablement in the AI era doesn’t fix a broken 70%. It inherits it.

Key Takeaways

- The Zero-Contact Enablement Gap is the distance between buyer perception formed independently and the reality sales inherits.

- Discovery must shift from uncovering pain to mapping perception the buyer already carries.

- AI copilots construct vendor narratives from your public signals. If you don’t design those signals, you inherit whatever the internet decided you are.

- Champion confidence and committee confidence are not the same thing. Deals stall when proof can’t survive being retold without the vendor in the room.

- The metric that matters: Can your champion make your case without you?

What is the Zero-Contact Enablement Gap?

The Zero-Contact Enablement Gap is the distance between the perception buyers form during the 70% of their decision made independently and the reality sales teams are prepared to validate in the 30% where they engage.

How does AI affect B2B vendor evaluation?

AI copilots construct vendor summaries from publicly available signals—case studies, reviews, LinkedIn content, and documentation. These summaries circulate inside buying committees before sales is ever contacted, shaping perception and evaluation criteria

What is perception mapping in B2B sales?

Perception mapping is a discovery approach where sales reps audit what the buyer already believes about them—based on AI-generated summaries, peer networks, and internal research—before introducing any new positioning.

Why do B2B deals stall after strong discovery?

Deals stall when champion confidence doesn’t convert to committee confidence. The champion believes in the solution but cannot retell the vendor’s proof in a way that survives scrutiny from finance, risk, and peer stakeholders.

How do you measure buyer confidence in B2B sales?

Buyer confidence is measured by whether anyone inside the account can make the vendor’s case without the vendor present—using a single verifiable outcome, portable proof, and a narrative that holds up under challenge.